Table of Contents

The Anchored VWAP (Volume Weighted Average Price) indicator is one such tool that has gained prominence for its ability to provide traders and investors with valuable insights into market trends and potential entry and exit points. In this comprehensive guide, we will delve into the Anchored VWAP indicator, explore its significance, and learn how to harness its power effectively in various trading and investing strategies.

What is the Anchored VWAP?

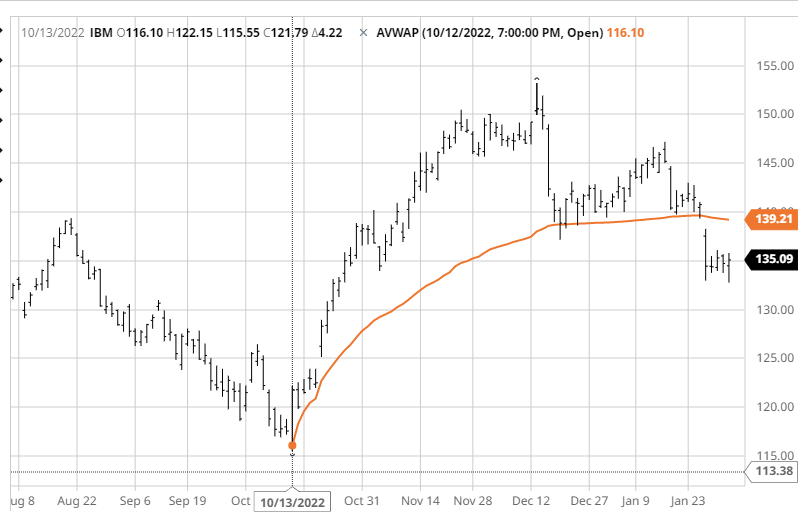

The Anchored VWAP indicator is an evolution of the traditional VWAP. While the VWAP calculates the average price of an asset over the course of a trading day, the Anchored VWAP takes this concept a step further by allowing traders to anchor the VWAP to a specific point in time. This reference point could be the opening price of a trading session, a significant news event, the start of a particular time frame, or any user-defined reference point chosen to suit their analysis.

How To Calculate The Anchored VWAP (Formula)?

Calculating the Anchored VWAP (Volume Weighted Average Price) involves summing the product of prices and volumes over a specified time period, from an anchor point to the current point in time. The formula for the Anchored VWAP is as follows:

Anchored VWAP = (Sum of (Price * Volume) from Anchor Point to Current Point) / (Sum of Volume from Anchor Point to Current Point)

Here’s a breakdown of the components in the formula:

- Anchor Point: This is the reference point in time from which you want to calculate the VWAP. It could be the opening price of a trading session, a significant news event, or any other specific time you choose for analysis.

- Price: The price of the asset traded at a given point in time.

- Volume: The trading volume (the number of shares or contracts traded) at that same point in time.

To calculate the Anchored VWAP, you sum the product of the price and volume for each time period from the anchor point to the current point. Then, you divide this sum by the total volume traded over the same period.

This calculation provides you with the weighted average price for the chosen time frame, anchored to your selected reference point. Traders use this indicator to gain insights into market trends and potential support and resistance levels at specific time intervals.

Variations of Anchored VWAP:

Traders can tailor the Anchored VWAP to suit their specific needs by selecting different anchor points and timeframes for analysis. Some common variations include:

- Opening Anchored VWAP: Anchored to the opening price of the trading day.

- Session Anchored VWAP: Anchored to the beginning of a specific trading session (e.g., morning or afternoon).

- Event-Driven Anchored VWAP: Anchored to significant news releases, earnings reports, or market events that can impact price action.

Practical Applications of Anchored VWAP:

- Identifying Key Support and Resistance Levels: Anchored VWAP levels often serve as dynamic support and resistance levels. Traders use them to assess potential entry and exit points, especially when the price approaches or interacts with these levels. This can help in determining the strength of trends and potential reversals.

- Confirmation of Breakouts: Traders seek confirmation of breakouts by analyzing the relationship between the price and the Anchored VWAP. When a price breakout is accompanied by a strong move above the Anchored VWAP, it may indicate a valid and sustainable breakout, helping traders make more informed decisions.

- Market Profile Analysis: Incorporating Anchored VWAP into market profile analysis provides traders with a comprehensive view of market behavior at specific price levels. This is particularly valuable for understanding intraday price movements, identifying areas of interest, and gauging market sentiment.

- Intraday Trading Strategies: Day traders frequently use the Anchored VWAP to fine-tune their intraday trading strategies. By anchoring it to key reference points during the trading day, traders gain insights into how market participants are reacting to different time frames, aiding in strategy refinement.

Importance of Anchored VWAP

The Anchored VWAP (Volume Weighted Average Price) indicator holds significant importance for traders and investors in the financial markets. Its significance lies in its ability to provide valuable insights into market behavior, potential entry and exit points, and trend analysis. Here are some key aspects of its significance:

- Precise Reference Points: The Anchored VWAP allows traders to anchor the VWAP to specific reference points in time, such as the beginning of a trading session, the start of a significant news event, or a user-defined point. This precision enables traders to analyze price action and volume behavior with a sharp focus on particular time frames.

- Dynamic Support and Resistance Levels: Anchored VWAP levels often act as dynamic support and resistance levels. Traders use these levels to assess the strength of trends and potential reversal points. When the price approaches or interacts with the Anchored VWAP, it can signal significant market sentiment shifts.

- Confirmation of Breakouts: Traders seek confirmation of breakouts by observing the relationship between the price and the Anchored VWAP. A breakout accompanied by a strong move above the Anchored VWAP can indicate a valid and sustained breakout, aiding traders in making more informed decisions.

- Intraday Trading Strategies: Day traders frequently use the Anchored VWAP to refine their intraday trading strategies. By anchoring it to key reference points during the trading day, traders gain insights into how market participants are reacting to different time frames, helping them fine-tune their strategies accordingly.

- Market Profile Analysis: Incorporating Anchored VWAP into market profile analysis provides traders with a comprehensive view of market behavior at specific price levels. This can be invaluable for understanding intraday price movements, identifying areas of interest, and gauging market sentiment.

- Price and Volume Validation: The Anchored VWAP combines price and volume data, providing a more holistic view of market activity. It can validate the significance of price moves by considering the associated trading volumes, helping traders distinguish between strong and weak market moves.

- Customization and Flexibility: Traders can customize the Anchored VWAP by selecting different anchor points and timeframes for analysis. This flexibility allows for tailored analysis based on specific trading strategies and objectives.

How To Interpret The Anchored VWAP?

Interpreting the Anchored VWAP (Volume Weighted Average Price) involves analyzing how it relates to the current market price and volume dynamics in the context of a chosen reference point. Here’s a step-by-step guide on how to interpret the Anchored VWAP effectively:

1. Select an Anchor Point: The first step is to choose a reference point in time from which you want to anchor the VWAP. This could be the opening price of the trading day, the start of a specific trading session, a significant news event, or any user-defined moment of interest.

2. Calculate the Anchored VWAP: Calculate the Anchored VWAP using the formula: Anchored VWAP = (Sum of (Price * Volume) from Anchor Point to Current Point) / (Sum of Volume from Anchor Point to Current Point) This calculation provides the VWAP for the selected time frame anchored to your reference point.

3. Analyze Price Interaction: Pay attention to how the current market price interacts with the Anchored VWAP:

- Price Above Anchored VWAP: If the current market price is above the Anchored VWAP, it may indicate bullish sentiment, suggesting that the asset is trading at an average price higher than the VWAP for that specific time frame. Traders may interpret this as a potential uptrend or a bullish bias.

- Price Below Anchored VWAP: Conversely, if the current market price is below the Anchored VWAP, it may indicate bearish sentiment, suggesting that the asset is trading at an average price lower than the VWAP for that time frame. Traders may see this as a potential downtrend or a bearish bias.

4. Volume Analysis: Examine the trading volume accompanying the price movement:

- High Volume with Price Above Anchored VWAP: A strong price move above the Anchored VWAP, coupled with high trading volume, can be interpreted as a robust bullish signal, indicating strong buying interest.

- High Volume with Price Below Anchored VWAP: Conversely, a significant price move below the Anchored VWAP, accompanied by high volume, can signal strong bearish sentiment and potential selling pressure.

5. Confirmation and Validation: The Anchored VWAP can be used to confirm or validate other technical indicators or trading signals. For example, if you’re considering a long trade, confirmation from the Anchored VWAP (price above VWAP) can add conviction to your entry.

6. Dynamic Support and Resistance: Consider how the Anchored VWAP levels act as dynamic support and resistance. If the price approaches or reacts strongly to the Anchored VWAP, it can indicate significant buying or selling pressure at that level.

7. Timeframe Selection: Keep in mind that the effectiveness of the Anchored VWAP interpretation depends on your choice of anchor point and timeframe. Experiment with different reference points and time intervals to align the analysis with your trading strategy and objectives.

8. Risk Management: Always integrate risk management strategies into your interpretation. Use stop-loss orders and position sizing to protect your capital, especially when interpreting Anchored VWAP in live trading scenarios.

5 Anchored VWAP Trading Strategies

1. Breakout Confirmation Strategy

- Objective: To confirm the validity of breakouts.

- How it Works in Detail:

- Start by identifying a potential breakout pattern on the price chart, such as a triangle, flag, or head and shoulders pattern.

- Choose an appropriate reference point for anchoring the VWAP. This point should be just before the breakout or at the breakout level itself.

- As the price breaks above the anchored VWAP, closely monitor the price action and volume. Look for confirmation signs such as strong and sustained upward momentum.

- Consider entering a long trade when the price convincingly breaks and closes above the anchored VWAP, indicating that buyers are in control.

- Implement stop-loss orders just below the breakout point to manage risk and preserve capital in case the breakout fails.

- Risk Management: Risk management is crucial in this strategy. Determine your risk-reward ratio before entering the trade and adjust your position size accordingly. Be prepared to exit the trade if the breakout confirmation falters.

2. Dynamic Support and Resistance Strategy

- Objective: To identify dynamic support and resistance levels.

- How it Works in Detail:

- Begin by anchoring the VWAP to a chosen reference point, such as the opening price of the trading day.

- Throughout the trading session, closely observe how the Anchored VWAP behaves in relation to the price.

- When the price approaches the Anchored VWAP and bounces off it, it indicates that the VWAP is acting as a potential support or resistance level.

- Use this information to plan your entry and exit points. For example, consider entering long positions when the price bounces off the Anchored VWAP as support and short positions when it encounters it as resistance.

- Implement stop-loss orders just beyond the Anchored VWAP level to manage risk.

- Risk Management: Properly place stop-loss orders and position sizes relative to the volatility of the asset and the distance from the Anchored VWAP level. This strategy relies on precise entries and exits.

3. Intraday Momentum Strategy

- Objective: To capture intraday price momentum.

- How it Works in Detail:

- Anchor the VWAP to the opening price of the trading day or the start of a specific trading session.

- Continuously monitor how the Anchored VWAP moves and interacts with the price throughout the trading day.

- When the price consistently trades above the Anchored VWAP, it suggests bullish momentum. This is an opportunity to consider long positions.

- Conversely, when the price consistently trades below the Anchored VWAP, it indicates bearish momentum and can be a signal for short positions.

- Risk Management: Customize your risk management approach to the specific asset’s volatility and your trading strategy. Use appropriate stop-loss orders and consider trailing stops to protect profits as the trade develops.

4. Event-Driven Strategy

- Objective: To capitalize on price movements following significant news events or earnings releases.

- How it Works in Detail:

- Anchor the VWAP to the exact time of the news event or earnings release.

- Pay close attention to how the Anchored VWAP responds to the event. A sharp move away from the VWAP can indicate a significant market reaction.

- Consider trading in the direction of the Anchored VWAP’s movement, anticipating that the price momentum initiated by the event will continue.

- Risk Management: Trading around news events carries inherent risks due to potential volatility. Set tight stop-loss orders and adjust your position size accordingly. Consider placing limits on the size of positions taken in such trades.

5. Swing Trading Strategy

- Objective: To identify potential swing trade opportunities.

- How it Works in Detail:

- Begin by anchoring the VWAP to a reference point of interest, such as a recent swing high or low, a key price level, or a prominent pivot point.

- Look for signs of price reversals or swings near the Anchored VWAP.

- Consider entering swing trades when the price approaches the Anchored VWAP and exhibits technical or fundamental signals suggesting a reversal or continuation of the trend.

- Risk Management: Establish a clear risk-reward ratio for each swing trade and implement stop-loss orders to limit potential losses. Have a defined exit strategy to lock in profits when the trade goes in your favor.

In all these strategies, traders should practice discipline and patience. It’s important to maintain a consistent approach to risk management and continually assess the effectiveness of your chosen Anchored VWAP trading strategy over time.

Difference Between VWAP Vs Anchored VWAP

VWAP (Volume Weighted Average Price) and Anchored VWAP (Anchored Volume Weighted Average Price) are related indicators used by traders and investors, but they differ in significant ways:

1. Calculation Method:

- VWAP: VWAP calculates the average price of an asset over a specific trading day or time period. It considers the volume-weighted average of prices throughout that entire period.

- Anchored VWAP: Anchored VWAP, on the other hand, allows traders to anchor the VWAP to a specific reference point in time. It calculates the volume-weighted average price from the anchor point to the current point in time.

2. Time Frame:

- VWAP: VWAP typically represents the average price for the entire trading day or a specific intraday session, such as morning or afternoon.

- Anchored VWAP: Anchored VWAP focuses on a particular time frame anchored to a chosen reference point. It can be customized to analyze price and volume behavior over shorter or longer time intervals.

3. Reference Point:

- VWAP: VWAP does not use an anchor point. It calculates the average price based on the entire trading day or session.

- Anchored VWAP: Anchored VWAP is anchored to a specific reference point chosen by the trader, such as the opening price of the trading day, a significant news event, or any user-defined point in time.

4. Use Cases:

- VWAP: VWAP is commonly used by traders and institutions to gauge the average price at which an asset has traded during a session. It helps identify trends, assess intraday trading opportunities, and determine whether an asset is trading above or below its average price for the day.

- Anchored VWAP: Anchored VWAP is used to gain insights into price and volume behavior relative to a specific reference point. It is valuable for identifying dynamic support and resistance levels, confirming breakouts, and assessing market sentiment at precise moments in time.

5. Flexibility:

- VWAP: VWAP is less flexible in terms of analyzing specific time intervals because it covers the entire trading session.

- Anchored VWAP: Anchored VWAP offers greater flexibility as traders can anchor it to different reference points and timeframes, allowing for more tailored analysis based on specific trading strategies and objectives.

In summary, while both VWAP and Anchored VWAP are volume-weighted average price indicators, the key difference lies in their calculation method and the ability of Anchored VWAP to focus on specific time frames anchored to chosen reference points. Traders often use VWAP for intraday analysis, while Anchored VWAP provides a more granular view of price and volume dynamics at precise moments in time, aiding in decision-making for various trading and investment strategies.

Pros and Cons Anchored VWAP

The Anchored VWAP (Volume Weighted Average Price) is a valuable trading and analysis tool, but like any indicator, it has its pros and cons. Understanding these can help traders make informed decisions about when and how to use it effectively.

Pros of Anchored VWAP:

- Precise Time-Frame Analysis: Anchored VWAP allows traders to analyze price and volume behavior at specific reference points in time. This precision can be valuable for intraday and swing traders looking to make well-timed decisions.

- Dynamic Support and Resistance: The Anchored VWAP often acts as dynamic support and resistance levels. These levels can help traders identify potential entry and exit points and assess the strength of trends.

- Confirmation of Breakouts: Traders use the Anchored VWAP to confirm the validity of breakouts. When the price convincingly moves above or below the Anchored VWAP with strong volume, it can provide confirmation of a breakout.

- Event-Driven Analysis: Anchored VWAP is useful for analyzing price movements in response to significant events, such as earnings releases or economic data. Traders can anchor the VWAP to the time of the event to gauge market sentiment.

- Customization: Traders have the flexibility to choose their anchor points and timeframes for analysis, allowing for tailored strategies based on specific trading objectives.

- Market Profile Insights: Anchored VWAP can be integrated into market profile analysis, providing a comprehensive view of market behavior at different price levels throughout the trading day.

Cons of Anchored VWAP:

- Subject to Anchoring Bias: The effectiveness of the Anchored VWAP depends on the chosen anchor point. Selecting an inappropriate reference point can lead to biased analysis and less reliable signals.

- Not Always a Standalone Indicator: While the Anchored VWAP can provide valuable insights, it is rarely used as a standalone indicator. Traders often combine it with other technical analysis tools for a more comprehensive view of the market.

- Complexity for Beginners: For novice traders, understanding how to anchor the VWAP effectively and interpret its signals can be challenging. It may require a learning curve and practice.

- Lack of Universality: Different traders may choose different anchor points, leading to variations in analysis and potentially conflicting signals in the market. This lack of universality can cause confusion.

- False Signals: Like any technical indicator, the Anchored VWAP is not immune to generating false signals. Traders should exercise caution and rely on additional confirming factors when making trading decisions.

- Requires Real-Time Data: To use the Anchored VWAP effectively, traders need access to real-time price and volume data. This can involve additional costs for data feeds or trading platforms.

Conclusion

The Anchored VWAP indicator stands as a versatile tool that empowers traders and investors to gain insights into market dynamics at specific reference points in time. By understanding its calculation and practical applications, traders can effectively incorporate the Anchored VWAP into their trading strategies. However, it’s essential to remember that no single indicator should be used in isolation.

Combining the Anchored VWAP with other technical analysis techniques, risk management strategies, and a comprehensive trading plan can lead to more well-informed and successful trading decisions. As you embark on your trading journey, consider the Anchored VWAP as a valuable addition to your toolkit, helping you navigate the intricate world of financial markets with confidence.

FAQs about Anchored VWAP

What Is Anchoring Bias in Anchored VWAP Analysis?

Anchoring bias is a cognitive bias where people rely too heavily on the first piece of information they receive when making decisions. In Anchored VWAP analysis, it can lead to biased trading decisions if traders anchor the VWAP to inappropriate reference points. Be mindful of this bias and choose anchor points carefully.

Can Anchored VWAP Be Used for Longer Timeframes Like Swing Trading or Investing?

Yes, Anchored VWAP can be applied to longer timeframes. Traders can anchor it to relevant reference points, providing insights for swing trading or investment strategies. Choose anchor points based on your analysis and objectives.

Are There Guidelines for Selecting Reference Points for Anchored VWAP?

Choose reference points based on your analysis and objectives. Common reference points include the opening price of the trading day, significant news events, or key support/resistance levels. There are no strict rules, but relevance is key.

Can Anchored VWAP Be Combined with Other Technical Indicators?

Yes, traders often combine Anchored VWAP with other indicators like moving averages, RSI, and MACD for a more comprehensive view of market conditions and better decision-making.

Is Anchored VWAP Suitable for All Types of Assets?

Anchored VWAP can be used for various assets like stocks, commodities, forex, and cryptocurrencies. Consider the asset’s characteristics and behavior when applying this tool.

Is Real-Time Data Necessary for Anchored VWAP Analysis?

Yes, real-time price and volume data are essential for accurate Anchored VWAP analysis. Access to real-time data is typically required for effective trading decisions.